Collective Call to Reject Governor’s Opioid Excise Tax in NYS Final Budget

On March 25, 2019 at the New York State Capitol, six lawmakers, patient, pharmacist and physician organizations (Assembly Member Linda Rosenthal [D-Manhattan], Chair of Assembly Committee on Alcoholism and Drug Abuse; Assembly Member Richard Gottfried [D-Manhattan], Chair of Assembly Committee on Health; Assembly Member John McDonald [D-Cohoes], Practicing Pharmacist; Kathyrn Carroll, Center for Disability Rights; Jun David, MD, Family Physician, NYS Academy of Family Physicians; Mike Duteau R.Ph, Pharmacist, Community Pharmacy Association of NYS) held a press conference to urge the rejection of New York State Governor Andrew Cuomo’s proposal of the so-called “opioid tax.”

ADVOCATES

Community Pharmacy Association of New York State

National Association of Chain Drug Stores

New York State Council of Health-System Pharmacists

Pharmacists Society of the State of New York

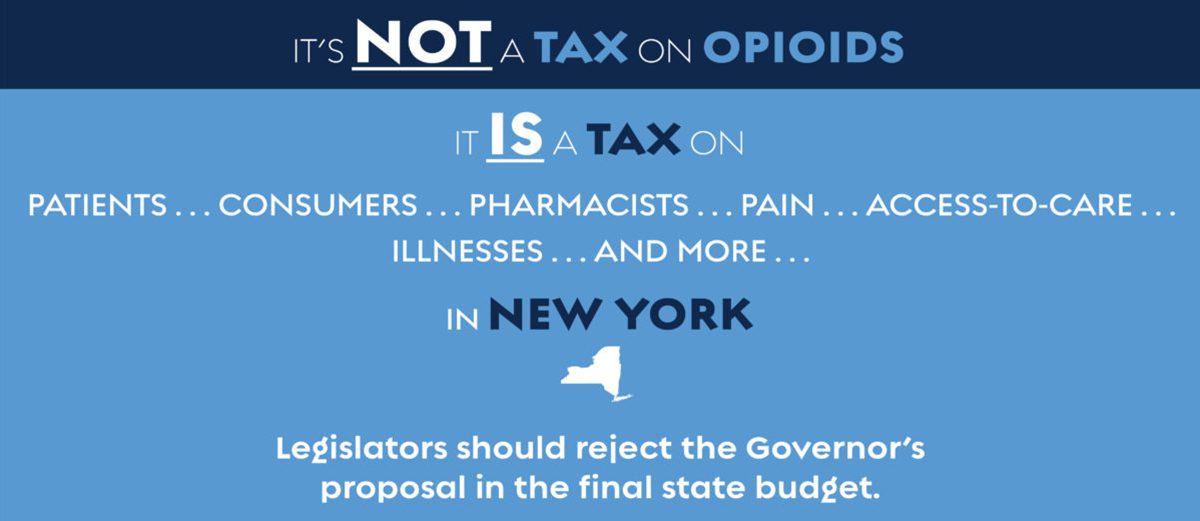

ISSUE

“This tax, while imposed on manufacturers and wholesalers, can and will be passed down to pharmacies, other providers like hospice and hospitals, and the vulnerable patients in need of pain relief for serious and legitimate reasons.

“Unfortunately, this is nothing more than a tax (imposed on prescription drugs for the first time) to generate $100 million to address a budget deficit.

“We are strongly opposed to the proposal due to how it will actually be applied and its unintended consequences.”

About the Tax

An excise tax in the governor's budget proposal would amount to a $100 million tax on vulnerable patients and pharmacy providers.The tax is to be charged against and paid by a registrant (a wholesaler/distributor, manufacturer or outsourcing facility). However, the proposal says “the tax may be passed down to the purchaser.” Pharmacies and patients stand together at the ultimate point of care delivery. There is nobody else to pass the tax onto – so it will fall on them.

The Consequences

Dangers to patient health are significant, and financial impacts for patients, pharmacies and hospitals would be crushing.This tax will hit the wallets of the most vulnerable patients. It threatens the viability of pharmacies, already facing below-cost reimbursement. Due to reimbursement models, hospitals will be unable to pass along added costs. The tax also creates dangerous incentives to use untaxed medications that are wrong for certain patients and conditions.

Myth/Fact

Myth: The tax would require manufacturers and distributors to provide funding to help address the opioid epidemic.The fact is that – because the tax can be passed on to others – it has no relationship to the stated objective. Further, there is no assurance the tax revenue will be used for education, treatment and other topics related to opioid abuse and addiction. While pharmacies are strong partners for solutions on these issues, they cannot absorb this $100 million tax.

Roll over or tap each square to learn more.

OPINION

Survey Question:

Which of the following statements about an opioid tax comes closest to your opinion, even if none are exactly right?

“An opioid tax is well-intentioned, but there are better solutions. The current design of an opioid tax will just end up hurting pharmacies and patients.”

“An opioid tax is not a solution. It’s just a money-grab by a state government. It is less about opioid abuse and more about finding a politically acceptable solution to financial difficulties.”

“An opioid tax is a good solution. Opioid abuse in the U.S. is so serious that something needs to be done to address it and to pay for its implications and costs.”

“Don’t know or no opinion”

National poll of 1,994 registered voters, conducted February 22-24, 2019, by Morning Consult and commissioned by NACDS (margin of error +/- 2%).

Editorial:

Albany Times Union – “Tax on pain would be cruel medicine”

“New York doesn’t tax prescription and over-the-counter drugs, and it shouldn’t open that door. Once opioids are taxed, the temptation to tax other medicines will be strong -— and prescriptions and drug coverage many New Yorkers already struggle to afford could become more costly.

“For all the problems they’ve caused, opioids are still vital for the people they are intended to help. Why should consumers who use opioids legitimately, including the terminally ill and others suffering from debilitating pain, be forced to pay more?

Editorial:

Newsday – “An inept plan to fight drug addiction”

“New York does not levy sales tax on either over-the-counter or prescription medication, and it shouldn’t. The people who most need such drugs are often the ones least able to afford them…

“This time the tax can be passed on to the consumer, making the law more likely to survive a legal challenge but worse for New Yorkers…

Op-ed:

New York Daily News – “The new opioid tax proposal will hurt patients”

By Assembly Member Linda Rosenthal (D-Manhattan)

“New York state’s newly re-imagined opioid tax puts patients, pharmacists and hospitals unfairly on the hook for curing the state’s opioid overdose crisis.”

“The new opioid tax in the proposed state budget, without safeguards to ensure that it cannot be levied on manufacturers only, has morphed into a punitive proposal that will unfairly tax patients. These people are not part of the problem, and New York should not balance the opioid budget on their backs.”

Op-ed:

New York Daily News – “Patients will feel the pain of Cuomo’s opioid tax”

By Lewis Davis, professor of economics, Union College

“New York State faces a huge revenue shortfall and a heartbreaking opioid crisis, so wouldn’t it make sense to support Gov. Cuomo’s plan to tax prescription opioids? The answer is no.

“In fact, the plan is more likely to have numerous unintended consequences and may make New York’s opioid addiction problem even worse…

“While the rhetoric around the proposal is targeted at drug manufacturers, our analysis shows the Cuomo tax most likely will raise costs on New Yorkers, punish legitimate pain patients and even drive addicts to use more deadly, illegal street drugs…

“Cuomo’s plan amounts to a tax on pain. It’s a tax on cancer patients, hospice patients and others suffering from legitimate chronic pain for which only prescription medication can provide relief.”

Op-ed:

The Daily Gazette – “Foss: Revamped opioid tax a bad idea”

By Sara Foss, columnist

“Bad ideas rarely die.

“Instead they mutate, taking on new yet still troubling forms.

“That’s what’s happened to Gov. Andrew Cuomo’s ill-fated plan to tax opioid distributors and manufacturers. Struck down as unconstitutional last year by a federal judge, the plan has been revived — and it’s even more misguided than before.”

Op-ed:

Albany Times Union – “Opioid Tax – Penalizing disabled and hospice patients”

By John T. McDonald III, Member, New York State Assembly

“This article by Nick Reisman of State of Politics speaks to yet another group (the Center for Disability Rights) that has come out against the proposed opioid tax in the state budget. They join many other groups including multiple medical providers as well as hospice groups in highlighting the potential impacts this opioid tax may have on suspecting patients. In as much as I respect the need for revenue in this budget, I find it troubling that there is a proposed tax for prescription medications on patients who will bear the burden of the tax either financially or through a lack of access to these medications that they need. I find it especially troubling that the proposal taxes those with disabilities and those who are in hospice.”

Op-ed:

RealClear Policy – “Cuomo’s Out of Control Craving for an Opioid Slush Fund”

By Jeff Stier, Senior Fellow, Consumer Choice Center

“Taxing legal opioid prescriptions isn’t just bad politics, it’s bad policy. ‘Taxing patients in pain’ wouldn’t make a popular campaign slogan. And because legitimate opioid prescriptions are no longer driving opioid abuse, taxing pain sufferers to pay for treatment and prevention of a black-market fentanyl fueled problem has no rational justification.

“Critics of the plan aren’t opioid crisis deniers. We believe that there are more sensible, compassionate — and effective — tools to address the problem than simply taxing pain patients to conjure up money for a so-called ‘opioid stewardship fund.’ If there’s one thing Albany has taught us, it’s that the state isn’t a good steward of slush funds, regardless of the severity of the problem at hand.”

COMMITMENT

Every day, pharmacists face a moment of truth. When presented with an opioid prescription, a pharmacist must make decisions as a provider of patient care, and as part of the drug-abuse solution. Based on these experiences on the front lines of care, and based on collaboration with law enforcement, pharmacies have a long-standing and ongoing commitment to initiatives that serve as part of the solution to opioid abuse and addiction.

Pharmacies’ collaborative efforts include:

- compliance programs;

- pioneering e-prescribing;

- drug disposal;

- patient education;

- security initiatives;

- fostering naloxone access;

- stopping illegal online drug-sellers and rogue clinics;

- philanthropic programs;

- and more.